2016 Limitations to Retirement Plans and Social Security Earnings

Generally each year, the IRS makes cost of living adjustments to many of the limits on benefits from — and contributions to — qualified and non-qualified retirement plans. Recently, the IRS announced the 2016 cost-of-living adjustments for pension plans and retirement-related items. In doing so, the IRS stated that “[ i ]n general, the pension plan limitations will not change for 2016 because the increase in the cost-of-living index did not meet the statutory thresholds that trigger their adjustment.” In general, the dollar limits are applied on a calendar year basis; however, certain of the dollar limitations are applied on a plan-year, tax-year or limitation-year basis. In addition, the Social Security administration announced the maximum amount of 2016 earnings subject to Social Security tax is unchanged and continues at $118,500.

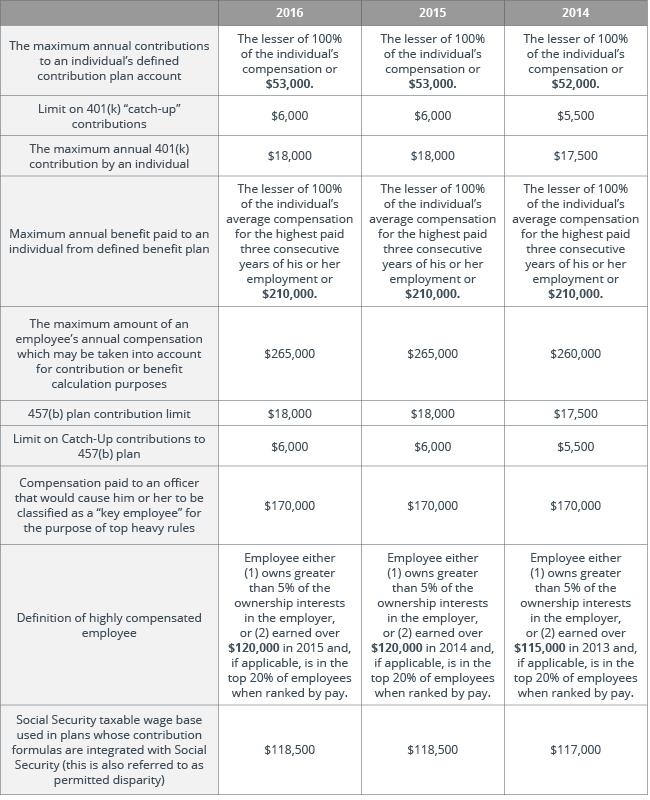

The table below sets forth the limitations for 2016 together with the 2014 and 2015 limitations: