January 21, 2000

401K Safe Harbors Work for Small Business

- January 21, 2000

- Publication: New York University - Proceedings of the Fifty-Eighth Institute on Federal Taxation

- Related Attorneys: Paula Calimafde, Deborah Cohn

- Related Practice Areas: Employee Benefits, Retirement Plans

This chapter will examine the history, the present and the future of 401(k) safe harbors.

The technical rules governing 401(k) safe harbors will be explained in detail and some flexible, yet simple, small business 401(k) safe harbor plan designs will be analyzed.

THE GENESIS OF THE 401(k) SAFE HARBORS

Stay clear of 401(k) plans! This was the advice given to small businesses not so long ago. They were considered too complicated and costly for a small company. Clearly, a small business could not properly administer a 401(k) plan by itself. The amount of 401(k) contributions that could be made by the highly compensated employees ("HCEs") was dependent upon the amount contributed by the non-highly compensated employees ("NHCEs") calculated under a forumla set forth in Section 401(k) of the Internal Revenue Code ("IRC"). Because of the complexities inherent in performing the anti-discrimination tests imposed by Section 401(k) and the regulations thereunder, (referred to as the "ADP tests"), a competent thid party administrator was virtually required if the plan was to be kept in operational conformity with the law.

...

News

March 21, 2023

Michelle Chapin’s Article on the Use of Arbitration Causes in Trusts is Published by the MSBA’s Estate & Trust Law Section

Michelle Chapin, a Principal in Paley Rothman’s Estate Planning department, authored an article titled "(Un)Enforceability of Arbitration Clauses in Maryland Trusts" in the MSBA's Estate & Trust Law Section Newsletter Volume 29 Issue 1.

Read MoreBlog

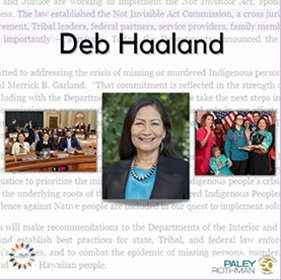

Sec. Deb Haaland – First Native American in the Cabinet

Sec. Deb Haaland is the first Native American to serve in the President’s cabinet and has been instrumental in bringing attention and action to the horrific incident rate of...

Read MoreResource Center

Paley Rothman shares this library of resources with clients and friends of the firm to help them stay ahead of legal and business developments and trends. Here, you will find helpful tips and tools written by our attorneys and relevant to our areas of practice.

Read More